Determining Priority in Perfected Security Interests

Who’s on first? This question decides what creditor gets paid, and what becomes an unsecured creditor whose best option is to recover pennies on the dollar for the money loaned to a business that purportedly had collateral. Priority to collateral needs determination to see who can seize it in satisfaction of its indebtedness to the business.

How and Where to File UCC Financing Statements

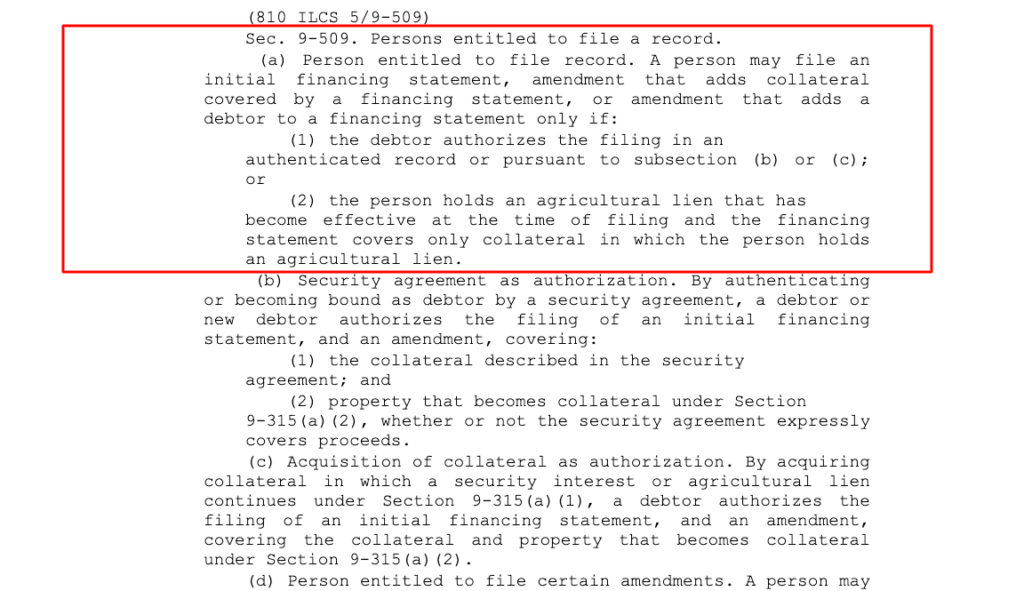

As a general rule, in all secured transactions involving a security agreement executed by the debtor, the debtor authorizes the secured party to file a financing statement describing the collateral. See 810 ILCS 5/9-509(a)(1). A financing statement perfects the lien in the collateral securing the transaction, often a loan to a business.

The financing statement is filed with the Secretary of State’s office in which the collateral is located, or the lien arose because some collateral is mobile. In addition, Article 9 provides that a person holding an agricultural lien that arises by operation of law and requires no written agreement may file a financing statement without consent provided the financing statement covers “only collateral in which the person holds an agricultural lien.” 810 ILCS 5/9-509(a)(2).

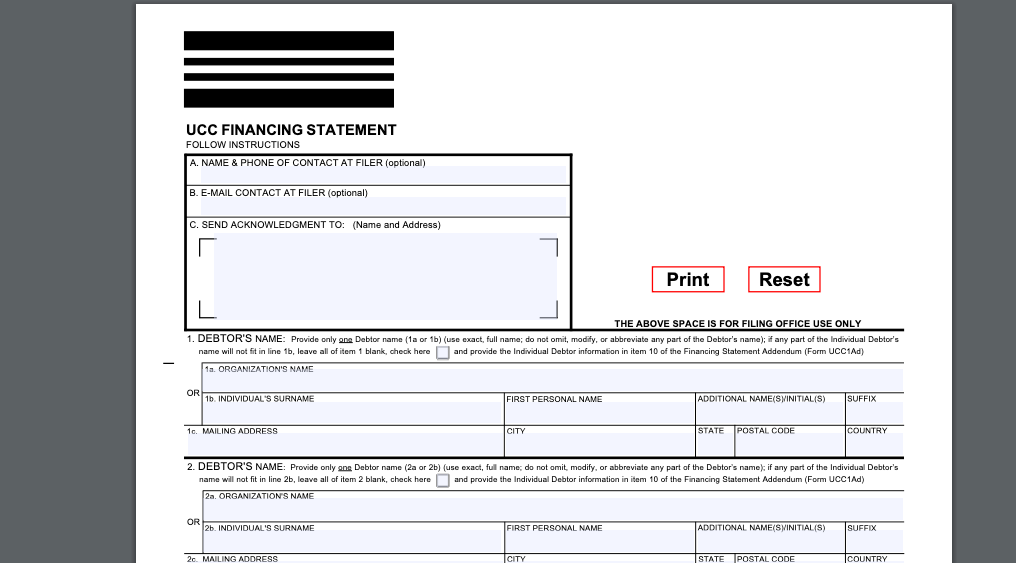

UCC Financing Statement Illinois Example

A UCC 1 in Illinois is common knowledge for commercial bankers and you can find a copy of the fillable PDF form LINKED HERE.

Description of Collateral for Perfection of UCC Lien

The financing statement does not need to include the legal description of leased real estate as a condition of perfection. Article 9 only requires this description only for “as-extracted collateral or timber to be cut.” 810 ILCS 5/9-502(b). “As-extracted collateral” means oil, gas, or other minerals that are subject to a security interest that is created by a debtor having an interest in the minerals before extraction and attaches to the minerals as extracted. 810 ILCS 5/9-102(a)(6). However, a legal description may be appropriate as an indication of “the collateral covered by the financing statement.” 810 ILCS 5/9-502(a)(3). One example is the landlord’s lien on crops growing on specific acreage. When the debtor is a tenant farmer that does not have a record interest in the real estate, counsel also must provide the name of the record owner. 810 ILCS 5/9-502(b)(4).

With a few exceptions, all financing statements are required to be filed in the office of the Secretary of State. 810 ILCS 5/9-501(a). The law governing perfection of priority of security interests is generally determined by the location of the debtor. 810 ILCS 5/9-301. For agricultural liens, the law governing priority is the local law of the jurisdiction where the farm products are located. 810 ILCS 5/9-302.

The debtor’s location depends on how the debtor is conducting the farm business. When a debtor is an individual, he or she is located at the individual’s principal residence. When the debtor is a non-registered organization, such as a general partnership, it is located at its place of business or its chief executive office if it has more than one place of business. 810 ILCS 5/9-307(b). However, when the debtor is an organization that is organized under state law, like a corporation or a limited liability company, it is located in the state where it is registered. 810 ILCS 5/9-307(e). The failure to file in the proper jurisdiction or to otherwise fail to satisfy the specific requirements for completing and filing the financing statement can be fatal. See, e.g., Duesterhaus Fertilizer, Inc. v. Capital Crossing Bank (In re Duesterhaus Fertilizer, Inc.), 347 B.R. 646 (Bankr. C.D.Ill. 2006).

Priorities: Which Agricultural Lien Wins?

In a conflict between security interests and agricultural liens in the same collateral, priority generally dates from the earlier of the time the filing covering the collateral is first made or the security interest or agricultural lien is first perfected. See 810 ILCS 5/9-322, 5/9-338.

A perfected security interest in growing crops has a priority over a conflicting interest of the owner or the mortgagee of the real property on which such crops are grown. 810 ILCS 5/9-334(i)(1)(A). The same priority applies between an assignee of a beneficial interest in an Illinois land trust and the holder of a perfected security interest in crops. See 810 ILCS 5/9-334(i)(1)(B). Lenders financing farm real estate that also want to maintain priority in crops must comply with Article 9 of the Uniform Commercial Code.

Whether this is your first land use issue or most recent, our office has helped people and businesses alike.

Thomas Howard was on the ball and got things done. Easy to work with, communicates very well, and I would recommend him anytime.